Tariff

| Taxation | ||||||||

|---|---|---|---|---|---|---|---|---|

| ||||||||

An aspect of fiscal policy | ||||||||

Policies

| ||||||||

Economics

| ||||||||

Collection

| ||||||||

Noncompliance

| ||||||||

Types

| ||||||||

International

| ||||||||

Trade

| ||||||||

Research

| ||||||||

Religious

| ||||||||

By country

| ||||||||

Average tariff rates for selected countries (1913–2007)

Tariff rates in Japan (1870–1960)

Average tariff rates in Spain and Italy (1860–1910)

Average tariff rates (France, UK, US)

Average tariff rates in US (1821–2016)

US Trade Balance and Trade Policy (1895–2015)

Average tariff rates on manufactured products

Average Levels of Duties (1875 and 1913)

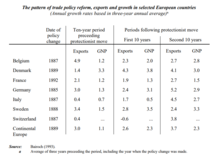

Trade Policy, Exports and Growth in European Countries

A tariff is a tax on imports or exports between sovereign states.

Contents

1 History

1.1 19th century

1.1.1 The Long Depression

1.2 Great Britain

1.3 United States

1.4 Tariff and the Great Depression

2 Arguments in favor of tariffs

2.1 Protection of emerging activities

2.2 Protection against dumping

2.3 Foreign trade and economic growth

2.4 The winner is the one who doesn't play the game

2.5 Free trade and poverty

3 Etymology

4 Customs duty

4.1 Calculation of customs duty

4.2 Harmonized System of Nomenclature

4.3 Customs authority

4.4 Evasion

4.5 Duty-free goods

4.6 Duty calculation for companies in real life

5 Economic analysis

5.1 Optimum tariff

6 Political analysis

7 Within technology strategies

8 See also

8.1 Types

8.2 Trade dynamics

8.3 Trade liberalisation

9 References

10 Further reading

10.1 Journal

10.2 Books

10.3 Websites

11 External links

History

19th century

According to Paul Bairoch (Myths and Paradoxes of Economic History, 1994), the industrialized world of 1913 is similar to that of 1815: "An ocean of protectionism surrounding a few liberal islets", with the exception of the United Kingdom, and a short free trade interlude in Europe between 1860 and 1892. On the other hand, "the Third World was an ocean of liberalism without an islet of protectionism", with Western countries imposing so-called "unequal" treaties on colonized and even politically dependent countries that required the lowering of customs barriers. He notes that:"in history, free trade is the exception and protectionism the rule"[1].

The Third World has suffered from the free trade imposed by the Western powers. The opening up of these economies was one of the main causes of the lack of development, since the import of large quantities of cheap manufactured goods led to a process of deindustrialization. India, for example, a British colony, has seen a highly developed textile craft industry disappear because of the trade imposed by Britain. Bairoch points out that:"Protectionism has always coincided in time with industrialization and economic development and is even at the origin of it"[1].

Trade liberalisation in the United Kingdom from 1846 onwards was the first example of large-scale liberalisation after the Industrial Revolution and was initiated by the dominant economy. However, it is the only country where over a specific period (during the two decades from 1846), free trade coincided with an increase in growth. Bairoch explains this by the fact that the country had a significant lead over the other countries in 1846, given that the country had emerged from at least half a century of protectionism[1].

It was in 1860 that free trade made a real breakthrough in continental Europe with the Cobden-Chevalier Treaty signed by Napoleon III. It was followed by other agreements signed between France and many other European countries: the Franco-Belgian treaty was signed in 1861 and between 1861 and 1866 almost all European countries joined the Cobden treaty[1].

The Long Depression

Paul Bairoch notes in Myths and Paradoxes of Economic History that the Great European Depression began around 1870-1872 at the height of free trade in Europe between 1866 and 1877 and ended with the return to protectionism around 1892:

"The important point is not only that the crisis started at the height of liberalism, but that it ended around 1892-1894, just as the return to protectionism became effective in continental Europe"[1].

He also notes that it was when all countries were strengthening protectionism that the growth rate reached its highest level in continental Europe: indeed, GNP growth rose from 1.1%/year in the years 1850-1870 (protectionist period) to 0.2%/year in the years 1870-1890 (free trade period). And it was the countries that had returned to protectionism that mainly benefited from the economic recovery: during the protectionist phase (after 1892), GNP growth was 1.5% in Mainland Europe , while in the United Kingdom, which continued free trade, the rate reached about 0.7%. In all countries except Italy, and regardless of the date of policy review, the adoption of protectionist measures (after 1892) was followed by a sharp acceleration in growth in the first ten years; in the following decade, which is the decade of increased protection, there was a further acceleration in growth. In contrast, in the United Kingdom, where there was no change in free trade policy, there was an initial period of stagnation followed by a sharp decline in the growth rate. Bairoch concludes that :

"It is almost certain that free trade coincided with the depression for which it was probably the cause, while protectionism was probably at the origin of growth and development in most of the current developed countries"[1].

In Europe, the slowdown in GNP growth was mainly the result of the decline in agricultural production growth; European tariff barriers were not completely eliminated on manufactured products, whereas they were totally eliminated on agricultural products in all countries. It was mainly the farmers who suffered because cheap imports led to the collapse of agricultural commodity prices; the farmers' standard of living fell or stagnated in almost all continental European countries. But it also affected overall demand for industrial goods and the construction sector[1]. During the 1870s and 1880s, the United States was Europe's largest supplier of cereals. There was an increasing trade imbalance between Europe and the United States until the 1900s, given that the United States had remained protectionist. The United States had not participated in the free trade movement and, on the contrary, had raised its level of protection. They experienced a period of strong growth while Europe was in the midst of a depression . Bairoch writes that with the exception of the United Kingdom between 1846 and 1875:

"The history of the nineteenth century shows that the effects of trade liberalism have been more negative than positive and, in contrast, shows that protectionist measures have most often had positive consequences" [1].

Great Britain

Edward III (1312–1377) was the first king who deliberately tried to expand the wool cloth manufacture. He brought Flemish weavers, centralized the raw wool trade and banned the importation of wool fabrics (Davies, 1999; Davis, 1966)[2].

The Tudor monarchs, particularly Henry VII (1485-1509), transformed England from a raw wool exporter into the world's largest wool manufacturing nation, through tariff (A Plan of the English Commerce, Daniel Defoe).[2].

In 1721, Robert Walpole, the first British Prime Minister, introduced the most significant political and economic reform in British history.

At the beginning of the 19th century, Britain's average tariff on manufactured goods was roughly 51 percent, the highest of any major nation in Europe. And even after Britain embraced free trade in most goods, it continued to tightly regulate trade in strategic capital goods, such as the machinery for the mass production of textiles[3]. Thus seen, according to Bairoch, Britain's technological lead had been achieved "behind high and long-lasting tariff barriers" (Economics and World History: Myths and Paradoxes, Bairoch).

In 1800, the United Kingdom, which accounted for about 8% to 10% of the European population, provided 29% of all pig iron produced in Europe, a proportion that reached 45% in 1830; industrial production per capita was even more significant: in 1830 it was 250% higher than in the rest of Europe compared to 110% in 1800. In 1846, the industrialization rate per capita was more than double that of its closest competitors such as France, Belgium, Germany, Switzerland and the United States[1].

Tariffs were reduced in 1833 and the Corn Law was repealed in 1846, which amounted to free trade in food. (The Corn Laws were passed in 1815 to restrict wheat imports and guarantee British farmers' incomes ). This devastated Britain's old rural economy. Tariffs on many manufactured goods have also been abolished (Economics and World History: Myths and Paradoxes, Bairoch). But as free trade progressed in the United Kingdom, protectionism continued on the continent[1].

British elites expected that thanks to free trade their lead in shipping, technology, scale economies and financial infrastructure to be self-reinforcing and thus last indefinitely. Britain practiced free trade unilaterally in the vain hope of imitation, but the United States emerged from the Civil War even more explicitly protectionist than before, Germany under Bismarck turned in this direction in 1879, and the rest of Europe followed. During the 1880s and 1890s, tariffs went up in Sweden, Italy, France, Austria-Hungary and Spain[3].

In the early 1860s, Europe and the United States pursued completely different trade policies. The 1860s were a period of growing protectionism in the United States, while the European free trade phase lasted from 1860 to 1892. The tariff average rate on imports of manufactured goods was in 1875 from 40% to 50% in the United States against 9% to 12% in continental Europe at the height of free trade. Between 1850 and 1870 the annual growth rate of GNP per capita was 1.8%, 2.1% between 1870 and 1890 and 2% between 1890 and 1910; the best twenty years of economic growth were therefore those of the most protectionist period (between 1870 and 1890), while European countries were following a free trade policy[1].

After the United States overtook European industries in the 1890s, the argument for the Mckinley tariff was no longer to protect the "infant industry" but rather to maintain workers' wage levels, improve protection of the agricultural sector and the principle of reciprocity[1].

Britain's economy still grew, but inexorably lagged: from 1870 to 1913, industrial production rose an average of 4.7 percent per year in the U.S., 4.1 percent in Germany, but only 2.1 percent in Britain. It was surpassed economically by the U.S. around 1880. Britain's lead in textiles and steelheld eroded as other nations caught up. Britain then fell behind as new industries, using more advanced technology, emerged after 1870 in states that still practiced protectionism[3].

Fundamentally, the country believed that free trade was optimal as a permanent policy and was satisfied with laissez faire absence of industrial policy. But contrary to British belief, free trade did not improve the economic situation and increased competition from foreign production eventually devastated Britain's old rural economy. Britain finally abandoned free trade in 1932 until 1950[3].

United States

The largest user of tariff was the United States. According to Paul Bairoch, the United States was "the homeland and bastion of modern protectionism" since the end of the 18th century and until after World War II.[4]

The Tariff Act was the second bill of the Republic signed by President George Washington allowing Congress to impose a fixed tariff of 5% on all imports, with a few exceptions. [3]

Most American intellectuals were against the free trade theory advocated by classical economists like Adam Smith, Ricardo and Jean Baptiste Say and were protecting their industries. Alexander Hamilton, the first Secretary of the Treasury of the United States (1789–1795) and economist Daniel Raymond were the first theorists of the emerging industry argument, not the German economist Friedrich List (Corden, 1974, c. 8; Reinert, 1996)[2].

Alexander Hamilton feared that Britain's policy towards the colonies would condemn the United States to be only producers of agricultural products and raw materials. Washington and Hamilton believed that political independence was predicated upon economic independence. Increasing the domestic supply of manufactured goods, particularly war materials, was seen as an issue of national security. He called in the Report on Manufactures for customs barriers to allow American industrial development and to help protect infant industries, including bounties (subsidies) derived in part from those tariffs.[5] Hamilton explained that despite an initial “increase of price” caused by regulations that control foreign competition, once a “domestic manufacture has attained to perfection… it invariably becomes cheaper”.

According to Michael Lind, protectionism was America's de facto policy from the passage of the Tariff of 1816 to World War II, "switching to free trade only in 1945"[6]. It has been argued that one of the underlying motivations for the American Revolution itself was a desire to industrialize, and reverse the trade deficit with Britain, which had grown by a factor of ten in the space of a few decades, from £67,000 (1721–30) to £739,000 (1761–70)[7].

In 1812, all tariffs were increased to 25% due to the war[8]. There was a brief episode of free trade from 1846 but the panic of 1857 eventually led to higher tariff demands than President James Buchanan, signed in 1861 (Morrill Tariff)[3].

In the 19th century, statesmen such as Senator Henry Clay continued Hamilton's themes within the Whig Party under the name "American System (Abraham Lincoln and the Tariff, R. Luthin, 1944)".

The American Civil War (1861-1865) was fought over the issue of tariffs as well as slavery. The agrarian interests of the South were opposed to any protection, while the manufacturing interests of the North wanted to maintain it.

The fledgling Republican Party led by Abraham Lincoln, who called himself a "Henry Clay tariff Whig", strongly opposed free trade, and implemented a 44-percent tariff during the Civil War—in part to pay for railroad subsidies and for the war effort, and to protect favored industries[9] In 1847, he declared: "Give us a protective tariff, and we shall have the greatest nation on earth"[3].

Alfred Eckes Jr notes that from 1871 to 1913, the average U.S. tariff on dutiable imports never fell below 38 percent and gross national product (GNP) grew 4.3 percent annually, twice the pace in free trade Britain and well above the U.S. average in the 20th century (Opening America's Market: U.S. Foreign Trade Policy Since 1776, Alfred Eckes Jr). According to Ian Fletcher, the protectionist periode "was the golden age of American industry, when America’s economic performance surpassed the rest of the world by the greatest margin"[3].

Tariff and the Great Depression

Most economists hold the opinion that the tariff act did not greatly worsen the great depression:

Milton Friedman held the opinion that the Smoot–Hawley tariff of 1930 did not cause the Great Depression, instead he blamed the lack of sufficient action on the part of the Federal Reserve. Douglas A. Irwin wrote: "most economists, both liberal and conservative, doubt that Smoot–Hawley played much of a role in the subsequent contraction".[10]

Peter Temin, an economist at the Massachusetts Institute of Technology, explained that a tariff is an expansionary policy, like a devaluation as it diverts demand from foreign to home producers. He noted that exports were 7 percent of GNP in 1929, they fell by 1.5 percent of 1929 GNP in the next two years and the fall was offset by the increase in domestic demand from tariff. He concluded that contrary the popular argument, contractionary effect of the tariff was small.[11]

William Bernstein wrote: "Between 1929 and 1932, real GDP fell 17 percent worldwide, and by 26 percent in the United States, but most economic historians now believe that only a miniscule part of that huge loss of both world GDP and the United States’ GDP can be ascribed to the tariff wars. .. At the time of Smoot-Hawley’s passage, trade volume accounted for only about 9 percent of world economic output. Had all international trade been eliminated, and had no domestic use for the previously exported goods been found, world GDP would have fallen by the same amount — 9 percent. Between 1930 and 1933, worldwide trade volume fell off by one-third to one-half. Depending on how the falloff is measured, this computes to 3 to 5 percent of world GDP, and these losses were partially made up by more expensive domestic goods. Thus, the damage done could not possibly have exceeded 1 or 2 percent of world GDP — nowhere near the 17 percent falloff seen during the Great Depression... The inescapable conclusion: contrary to public perception, Smoot-Hawley did not cause, or even significantly deepen, the Great Depression"(A Splendid Exchange: How Trade Shaped the World)

Nobel laureate Maurice Allais argued that:

First, most of the trade contraction occurred between January 1930 and July 1932, before most protectionist measures were introduced, except for the limited measures applied by the United States in the summer of 1930. It was therefore the collapse of international liquidity that caused the contraction of trade[8], not customs tariffs.

Second, domestic output in the major industrialized countries fell faster than international trade contracted, so it was not the contraction in foreign trade that caused the depression, but rather the reverse (it was the fall in domestic demand in the countries that caused the contraction in foreign trade). This indicates that it is the domestic growth of countries that generate foreign trade, not the reverse. So protecting domestic production through tariffs is more important than safeguarding foreign trade.

Maurice Allais concludes that higher trade barriers were a means of protecting domestic demand from external shocks, deflation, and deregulation of competition in the global labour market.[12]

Arguments in favor of tariffs

Protection of emerging activities

In the 19th century, Alexander Hamilton and the economist Friedrich List defended the benefits of "educator protectionism" as a necessary means of protecting infant industries. Protectionism would be necessary in the short term for a country to start industrialization away from competition from more advanced foreign industries, under which pressure it could succumb at the first stage of the process. As a result, they benefit from greater freedom of manoeuvre and greater certainty regarding their profitability and future development. The protectionist phase is therefore a learning period that would allow the least developed countries to acquire general and technical know-how in the fields of industrial production in order to become competitive on international markets.

Protection against dumping

States resorting to protectionism invoke unfair competition or dumping practices:

- Monetary dumping: a currency undergoes a devaluation when monetary authorities decide to intervene in the foreign exchange market to lower the value of the currency against other currencies. This makes local products more competitive and imported products more expensive (Marshall Lerner Condition), increasing exports and decreasing imports, and thus improving the trade balance. Countries with a weak currency cause trade imbalances: they have large external surpluses while their competitors have large deficits.

- Tax Dumping: some tax haven states have lower corporate and personal tax rates.

- Social dumping: when a state reduces social contributions or maintains very low social standards (for example, in China, labour regulations are less restrictive for employers than elsewhere).

- Environmental dumping: when environmental regulations are less stringent than elsewhere.

Foreign trade and economic growth

According to Paul Bairoch, "it is economic growth that generates foreign trade, not the opposite". James Riedel, also comes to the same conclusion in his study entitled Trade as an engine of growth: Theory and Evidence and writes: "in reality, there is very little left of the assumptions that generated the mechanistic conclusions of trade theory as an engine of growth" [...]

"A thorough examination of the stylised facts that underline the theory of trade as an growth engine reveals that it is only a myth"[1]. Domestic production is therefore more important for economic growth than foreign trade. Thus, promoting economic development requires protecting domestic production rather than sacrificing it (because of trade deficits) for the benefit of liberalization and expansion of foreign trade. Bairoch notes several examples[1]:

- During "The Long Depression, the economic slowdown of nations preceded that of foreign trade. This indicates that it is national growth that drives foreign trade.

- During the 1929 Great Depression, it was the decline in the nations' domestic production that preceded that of foreign trade: at the world level, in 1930, the world's industrial production (minus Russia) fell by 14% while the volume of world trade fell by only 7%; In 1931, the figures were -13% for industry and -8% for world trade; in 1932 they were -15% for industry and -13% for world trade. In the United States, industrial production had declined since October 1929, while the value of all American exports rose by 20% and that of manufactured goods exports by 5%[1].

The winner is the one who doesn't play the game

The poor countries that have succeeded in achieving strong and sustainable growth are those that have become mercantilists, not free traders: China, South Korea, Japan, Taiwan...Thus, whereas in the 1990s, China and India had the same GDP per capita, China followed a much more mercantilist policy and now has a GDP per capita three times higher than India's. Dani Rodrik points out that it is the countries that have systematically violated the rules of globalisation that have experienced the strongest growth[13]. Bairoch notes that in the free trade system, "the winner is the one who does not play the game"[1].

For developed countries that have implemented free trade, the work of E.F. Denison on growth factors in the United States and Western Europe between 1950 and 1962 shows that the positive effects on growth of trade liberalization have been negligible in the United States, while in Western Europe it contributed to a weighted average of only 2% of total economic growth. J W W Kendrick whose work deals with GNP growth in the United States comes to the same conclusion[1].

Free trade and poverty

According to Paul Bairoch, a very large number of Third World countries that have followed free trade can now be considered as "quasi industrial deserts"; he notes that: "Free trade meant for the Third World the acceleration of the process of economic underdevelopment[1].

Poor countries have become even poorer since they removed economic protections in the early 1980s. In 2003, 54 nations were poorer than they were in 1990 (UN Human Development Report 2003, p. 34). During the 1960s and 1970s, when countries had more protection, the world economy grew much faster than today - world per capita income grew by about 3% per year, while over the next 20 years (free trade) period it grew by only about 2%. Growth in per capita income in developed countries increased from 3.2%/year between 1960 and 1980 to 2.2%/year between 1980 and 1999 (free trade period), while in developing countries it increased from 3% to 1.5%/year. Without the strong growth of the past two decades in China and India, which have followed other policies, the rate would have been even lower[14].

In Latin America, the annual growth rate of per capita income increased from 3.1%/year between 1960 and 1980 to 0.6%/year between 1980 and 1999 (free trade period). The crisis was even more profound in other regions: over the next 20 years, per capita income declined in the Middle East and North Africa (at an annual rate of -0.2%), while it increased by 2.5%/year between 1960 and 1980. Finally, since the beginning of their economic transition, most former communist countries have experienced the fastest declines in living standards in modern history, and many of them have not even regained half the level of per capita income under communism[14].

Sub-Saharan African countries have a lower per capita income in 2003 than 40 years earlier (Ndulu, World Bank, 2007, p. 33)[15]. By practicing free trade, Africa is less industrialized today than it was four decades ago. The contribution of the African manufacturing sector to the continent's gross domestic product declined from 12% in 1980 to 11% in 2013, and has remained stagnant in recent years, according to the United Nations Economic Commission for Africa (ECA). It is estimated that Africa accounted for more than 3% of world manufacturing output in the 1970s, and this percentage has declined by half since. Between 1980 and 2000 (free trade period), per capita income in sub-Saharan Africa fell by 9%, while interventionist policies had increased it by 37% over the previous two decades. Economic growth returned to Africa in the 2000s but was mainly driven by the commodity price boom, fuelled by China's rapid growth in need of natural resources. But even after a decade of unprecedented expansion, per capita income in the region in 2012 is only 10% higher than in 1980, given the economic depression caused by laissez-faire policies in the 1980s and 1990s. Moreover, by applying the laissez-faire approach, few African countries have been able to convert their recent resources into a more sustainable industrial base. And over the past decade, many African countries have increased, rather than reduced, their dependence on primary commodities, whose notoriously large price fluctuations make sustained growth difficult[14].

However, some African countries have managed to enter an industrialization phase: Ethiopia, Rwanda and, to a lesser extent, Tanzania. The common denominator among them is that they have abandoned free trade and adopted policies that target and promote their own manufacturing industries. They have pursued a "developmental state model" where governments manage and regulate economies. Thus, since 2006, the Ethiopian manufacturing sector has grown at an average annual rate of more than 10%, although from a very low base[14].

Etymology

The small Spanish town of Tarifa is sometimes credited with being the origin of the word "tariff", since it was the first port in history to charge merchants for the use of its docks.[16] The name "Tarifa" itself is derived from the name of the Berber warrior, Tarif ibn Malik. However, other sources assume that the origin of tariff is the Italian word tariffa translated as "list of prices, book of rates", which is derived from the Arabic ta'rif meaning "making known" or "to define".[17]

Customs duty

A customs duty or due is the indirect tax levied on the import or export of goods in international trade. In economic sense, a duty is also a kind of consumption tax. A duty levied on goods being imported is referred to as an import duty. Similarly, a duty levied on exports is called an export duty. A tariff, which is actually a list of commodities along with the leviable rate (amount) of customs duty, is popularly referred to as a customs duty.

Calculation of customs duty

Customs duty is calculated on the determination of the assessable value in case of those items for which the duty is levied ad valorem. This is often the transaction value unless a customs officer determines assessable value in accordance with the Harmonized System. For certain items like petroleum and alcohol, customs duty is realized at a specific rate applied to the volume of the import or export consignments.

Harmonized System of Nomenclature

For the purpose of assessment of customs duty, products are given an identification code that has come to be known as the Harmonized System code. This code was developed by the World Customs Organization based in Brussels. A Harmonized System code may be from four to ten digits. For example, 17.03 is the HS code for molasses from the extraction or refining of sugar. However, within 17.03, the number 17.03.90 stands for "Molasses (Excluding Cane Molasses)".

Introduction of Harmonized System code in 1990s has largely replaced the Standard International Trade Classification (SITC), though SITC remains in use for statistical purposes. In drawing up the national tariff, the revenue departments often specifies the rate of customs duty with reference to the HS code of the product. In some countries and customs unions, 6-digit HS codes are locally extended to 8 digits or 10 digits for further tariff discrimination: for example the European Union uses its 8-digit CN (Combined Nomenclature) and 10-digit TARIC codes.

Customs authority

A Customs authority in each country is responsible for collecting taxes on the import into or export of goods out of the country. Normally the Customs authority, operating under national law, is authorized to examine cargo in order to ascertain actual description, specification volume or quantity, so that the assessable value and the rate of duty may be correctly determined and applied.

Evasion

Evasion of customs duties takes place mainly in two ways. In one, the trader under-declares the value so that the assessable value is lower than actual. In a similar vein, a trader can evade customs duty by understatement of quantity or volume of the product of trade. A trader may also evade duty by misrepresenting traded goods, categorizing goods as items which attract lower customs duties. The evasion of customs duty may take place with or without the collaboration of customs officials. Evasion of customs duty does not necessarily constitute smuggling.[citation needed]

Duty-free goods

Many countries allow a traveler to bring goods into the country duty-free. These goods may be bought at ports and airports or sometimes within one country without attracting the usual government taxes and then brought into another country duty-free. Some countries impose allowances which limit the number or value of duty-free items that one person can bring into the country. These restrictions often apply to tobacco, wine, spirits, cosmetics, gifts and souvenirs. Often foreign diplomats and UN officials are entitled to duty-free goods. Duty-free goods are imported and stocked in what is called a bonded warehouse.

Duty calculation for companies in real life

With many methods and regulations, businesses at times struggle to manage the duties. In addition to difficulties in calculations, there are challenges in analyzing duties; and to opt for duty free options like using a bonded warehouse.

Companies use ERP software to calculate duties automatically to, on one hand, avoid error-prone manual work on duty regulations and formulas and on the other hand, manage and analyze the historically paid duties. Moreover, ERP software offers an option for customs warehouse, introduced to save duty and VAT payments. In addition, the duty deferment and suspension is also taken into consideration.

Economic analysis

Diagram showing effects of import tariff, which hurts domestic consumers more than domestic producers are helped. Higher prices and lower quantities reduce consumer surplus by areas A+B+C+D, while expanding producer surplus by A and government revenue by C. Areas B and D are dead-weight losses, surplus lost by consumers and overall.[18]

Shows the consumer surplus, producer surplus, government revenue, and deadweight losses after tariff imposition.

Neoclassical economic theorists tend to view tariffs as distortions to the free market. Typical analyses find that tariffs tend to benefit domestic producers and government at the expense of consumers, and that the net welfare effects of a tariff on the importing country are negative. Normative judgments often follow from these findings, namely that it may be disadvantageous for a country to artificially shield an industry from world markets and that it might be better to allow a collapse to take place. Opposition to all tariff aims to reduce tariffs and to avoid countries discriminating between differing countries when applying tariffs. The diagrams at right show the costs and benefits of imposing a tariff on a good in the domestic economy.[18]

Imposing an import tariff has the following effects, shown in the first diagram in a hypothetical domestic market for televisions:

- Price rises from world price Pw to higher tariff price Pt.

- Quantity demanded by domestic consumers falls from C1 to C2, a movement along the demand curve due to higher price.

- Domestic suppliers are willing to supply Q2 rather than Q1, a movement along the supply curve due to the higher price, so the quantity imported falls from C1-Q1 to C2-Q2.

Consumer surplus (the area under the demand curve but above price) shrinks by areas A+B+C+D, as domestic consumers face higher prices and consume lower quantities.

Producer surplus (the area above the supply curve but below price) increases by area A, as domestic producers shielded from international competition can sell more of their product at a higher price.- Government tax revenue is the import quantity (C2-Q2) times the tariff price (Pw - Pt), shown as area C.

- Areas B and D are deadweight losses, surplus formerly captured by consumers that now is lost to all parties.

The overall change in welfare = Change in Consumer Surplus + Change in Producer Surplus + Change in Government Revenue = (-A-B-C-D) + A + C = -B-D. The final state after imposition of the tariff is indicated in the second diagram, with overall welfare reduced by the areas labeled "societal losses", which correspond to areas B and D in the first diagram. The losses to domestic consumers are greater than the combined benefits to domestic producers and government.[18]

Besides that above analysis is by a partial equilibrium analysis, however by a general equilibrium analysis, it showed that the income transfer caused among to the welfare concerned to the production of the good imposed tariff from the another welfare of production.[19]

That tariffs overall reduce welfare is not a controversial topic among economists. For example, the University of Chicago surveyed about 40 leading economists in March 2018 asking whether "Imposing new U.S. tariffs on steel and aluminum will improve Americans'welfare." About two-thirds strongly disagreed with the statement, while one third disagreed. None agreed or strongly agreed. Several commented that such tariffs would help a few Americans at the expense of many.[20] This is consistent with the explanation provided above, which is that losses to domestic consumers outweigh gains to domestic producers and government, by the amount of deadweight losses.[21]

Tariffs are more inefficient than consumption taxes.[22]

Optimum tariff

For economic efficiency, free trade is often the best policy, however levying a tariff is sometimes second best.

A tariff is called an optimal tariff if it's set to maximize the welfare of the country imposing the tariff.[23] It is a tariff derived by the intersection between the trade indifference curve of that country and the offer curve of another country. In this case, the welfare of the other country grows worse simultaneously, thus the policy is a kind of beggar thy neighbor policy. If the offer curve of the other country is a line through the origin point, the original country is in the condition of a small country, so any tariff worsens the welfare of the original country.[24][25]

It is possible to levy a tariff as a political policy choice, and to consider a theoretical optimum tariff rate.[26] When countries impose tarrifs on each other, they will reach a position on the contract curve, which indicates a combination of trade quantities that satisfy each others maximum welfare, with the countries trade own goods between each other.[27]

Political analysis

The tariff has been used as a political tool to establish an independent nation; for example, the United States Tariff Act of 1789, signed specifically on July 4, was called the "Second Declaration of Independence" by newspapers because it was intended to be the economic means to achieve the political goal of a sovereign and independent United States.[28]

The political impact of tariffs is judged depending on the political perspective; for example the 2002 United States steel tariff imposed a 30% tariff on a variety of imported steel products for a period of three years and American steel producers supported the tariff.[29]

Tariffs can emerge as a political issue prior to an election. In the leadup to the 2007 Australian Federal election, the Australian Labor Party announced it would undertake a review of Australian car tariffs if elected.[30] The Liberal Party made a similar commitment, while independent candidate Nick Xenophon announced his intention to introduce tariff-based legislation as "a matter of urgency".[31]

Unpopular tariffs are known to have ignited social unrest, for example the 1905 meat riots in Chile that developed in protest against tariffs applied to the cattle imports from Argentina.[32][33]

Within technology strategies

When tariffs are an integral element of a country's technology strategy, some economists believe that such tariffs can be highly effective in helping to increase and maintain the country's economic health. Other economists might be less enthusiastic, as tariffs may reduce trade and there may be many spillovers and externalities involved with trade and tariffs. The existence of these externalities makes the imposition of tariffs a rather ambiguous strategy. As an integral part of the technology strategy, tariffs are effective in supporting the technology strategy's function of enabling the country to outmaneuver the competition in the acquisition and utilization of technology in order to produce products and provide services that excel at satisfying the customer needs for a competitive advantage in domestic and foreign markets. The notion that government and policy would be effective at finding new and infant technologies, rather than supporting existing politically motivated industry, rather than, say, international technology venture specialists, is however, unproven.

This is related to the infant industry argument.

In contrast, in economic theory tariffs are viewed as a primary element in international trade with the function of the tariff being to influence the flow of trade by lowering or raising the price of targeted goods to create what amounts to an artificial competitive advantage. When tariffs are viewed and used in this fashion, they are addressing the country's and the competitors' respective economic healths in terms of maximizing or minimizing revenue flow rather than in terms of the ability to generate and maintain a competitive advantage which is the source of the revenue. As a result, the impact of the tariffs on the economic health of the country are at best minimal but often are counter-productive.

A program within the US intelligence community, Project Socrates, that was tasked with addressing America's declining economic competitiveness, determined that countries like China and India were using tariffs as an integral element of their respective technology strategies to rapidly build their countries into economic superpowers. However, the US intelligence community tends to have limited inputs into developing US trade policy. It was also determined that the US, in its early years, had also used tariffs as an integral part of what amounted to technology strategies to transform the country into a superpower.[34]

See also

- Embargo

- Protectionism

- Trade barrier

Types

- Ad valorem tax

- Bound tariff rate

- Environmental tariff

- Import quota

- List of tariffs

- Tariff-rate quota

- Telecommunications tariff

- Electricity tariff

Trade dynamics

- Effective rate of protection

- Tariffication

Trade liberalisation

General Agreement on Tariffs and Trade (GATT)- International free trade agreement

- Swiss Formula

- United States International Trade Commission

References

^ abcdefghijklmnopqr PAUL BAIROCH. Economics and World History myths and paradoxes..mw-parser-output cite.citationfont-style:inherit.mw-parser-output qquotes:"""""""'""'".mw-parser-output code.cs1-codecolor:inherit;background:inherit;border:inherit;padding:inherit.mw-parser-output .cs1-lock-free abackground:url("//upload.wikimedia.org/wikipedia/commons/thumb/6/65/Lock-green.svg/9px-Lock-green.svg.png")no-repeat;background-position:right .1em center.mw-parser-output .cs1-lock-limited a,.mw-parser-output .cs1-lock-registration abackground:url("//upload.wikimedia.org/wikipedia/commons/thumb/d/d6/Lock-gray-alt-2.svg/9px-Lock-gray-alt-2.svg.png")no-repeat;background-position:right .1em center.mw-parser-output .cs1-lock-subscription abackground:url("//upload.wikimedia.org/wikipedia/commons/thumb/a/aa/Lock-red-alt-2.svg/9px-Lock-red-alt-2.svg.png")no-repeat;background-position:right .1em center.mw-parser-output .cs1-subscription,.mw-parser-output .cs1-registrationcolor:#555.mw-parser-output .cs1-subscription span,.mw-parser-output .cs1-registration spanborder-bottom:1px dotted;cursor:help.mw-parser-output .cs1-hidden-errordisplay:none;font-size:100%.mw-parser-output .cs1-visible-errorfont-size:100%.mw-parser-output .cs1-subscription,.mw-parser-output .cs1-registration,.mw-parser-output .cs1-formatfont-size:95%.mw-parser-output .cs1-kern-left,.mw-parser-output .cs1-kern-wl-leftpadding-left:0.2em.mw-parser-output .cs1-kern-right,.mw-parser-output .cs1-kern-wl-rightpadding-right:0.2em

^ abc "Kicking Away the Ladder: The "Real" History of Free Trade - FPIF". 30 December 2003.

^ abcdefgh Fletcher, Ian (12 September 2010). "America Was Founded as a Protectionist Nation".

^ Chang, Ha-Joon; Gershman, John. "Kicking Away the Ladder: The "Real" History of Free Trade". ips-dc.org. Institute for Policy Studies. Retrieved 1 September 2017.

^ Morrison, Spencer P. (December 23, 2016). "America's Protectionist Past: The Hidden History Of Trade". National Economics Editorial. Retrieved December 30, 2016.

^ Michael Lind, "Free Trade Fallacy",New America Foundation, January 1, 2003

^ Morrison, Spencer P (2016). America Betrayed. Edmonton: Outremer Publishing Ltd. p. 67.

^ Morrison, Spencer P. (December 23, 2016). "America's Protectionist Past: The Hidden History Of Trade". National Economics Editorial. Retrieved January 4, 2017.

^ Lind, Matthew. "Free Trade Fallacy". Prospect. Archived from the original on January 6, 2006. Retrieved January 3, 2011.

^ Irwin, Douglas A. (2011). Peddling Protectionism: Smoot-Hawley and the Great Depression. p. 116. ISBN 9781400888429.

^ Temin, P. (1989). Lessons from the Great Depression. MIT Press. ISBN 9780262261197.

^ Maurice Allais (December 5–11, 2009). "Lettre aux français : contre les tabous indiscutés" (pdf). Marianne (in French). p. 38.

^ http://drodrik.scholar.harvard.edu/files/dani-rodrik/files/after-neoliberalism-what.pdf

^ abcd Erik S. Reinert. How Rich Countries Got Rich… and Why Poor Countries Stay Poor.

^ http://siteresources.worldbank.org/AFRICAEXT/Resources/AFR_Growth_Advance_Edition.pdf

^ Chambers Dictionary of Etymology, New York, 1997, ISBN 0-550-14230-4

^ The Online Etymology Dictionary: tariff. The 2nd edition of the Oxford English Dictionary gives the same etymology, with a reference dating to 1591.

^ abc Krugman, Paul and, Wells, Robin (2005). Microeconomics. Worth. ISBN 978-0-7167-5229-5.

^ Stolper & Samuelson (1941).

^ University of Chicago IGM Panel-Steel And Aluminum Tariffs-March 12, 2018

^ Krugman & Wells (2005).

^ Diamond, Peter A.; Mirrlees, James A. (1971). "Optimal Taxation and Public Production I: Production Efficiency". The American Economic Review. 61 (1): 8–27. JSTOR 1910538.

^ El-Agraa, 1984 & p.26(by Japanese ed.).

^ Almost all real life examples may be in this case.

^ El-Agraa (1984), pp. 8–35(in 8–45 by the Japanese ed.), Chap.2 保護:全般的な背景.

^ El-Agraa (1984), p. 76 (by the Japanese ed., Chap. 5 「雇用-関税」命題の政治経済学的評価.

^ El-Agraa (1984), p. 93 (in 83-94 by the Japanese ed.), Chap. 6 最適関税、報復および国際協力.

^ "Thomas Jefferson – under George Washington by America's History". americashistory.org. Archived from the original on 2012-07-08.

^ "Behind the Steel-Tariff Curtain". Business Week Online. March 8, 2002.

^ Sid Marris and Dennis Shanahan (November 9, 2007). "PM rulses out more help for car firms". The Australian. Archived from the original on 2007-11-09. Retrieved 2007-11-11.

^ "Candidate wants car tariff cuts halted". Melbourne: theage.com.au. October 29, 2007.

^ (in Spanish) Primeros movimientos sociales chileno (1890–1920). Memoria Chilena.

^ Benjamin S. 1997. Meat and Strength: The Moral Economy of a Chilean Food Riot. Cultural Anthropology, 12, pp. 234–268.

^ Watts, Denise K. (1990-06-28). "Martin County News". Gathering Information on High Technology.

Further reading

Journal

Stolper, W. F.; Samuelson, P. A. (1941). "Protection and Real Wages". Review of Economic Studies. 9.

Books

岡山, 隆; 岩田, 仲人; 宮川, 典之 (1992-05-30). ECの貿易政策―国際貿易の理論と政策― (in jp). Tokyo: 株式会社文眞堂. ISBN 978-4-8309-4082-8.CS1 maint: Unrecognized language (link) translated from

El-Agraa, Ali M. (1984). TRADE THEORY AND POLICY. The Macmillian Press Ltd.

Krugman, Paul; Wells, Robin (2005). Macroeconomics. Worth. ISBN 978-0-7167-5229-5.

Salvatore, Dominick (2005), Introduction to International Economics (First ed.), Hoboken, NJ: Wiley, ISBN 978-0-471-20226-4.

Websites

- Biswas, R. (2014). Tariffs that may fail to protect: A model of trade and public goods, MPRA Paper 56707, University Library of Munich, Germany.

- Dal Bianco A., Boatto V., Caracciolo F., Santeramo F.G. (2016) Tariffs and non-tariff frictions in the world wine trade European Review of Agricultural Economics. 43(1):31–57 (Link to Working Paper)

- U.S. Tariff Commission. Colonial tariff policies (1922), worldwide; 922pp

External links

![]() Media related to tariffs at Wikimedia Commons

Media related to tariffs at Wikimedia Commons

Wikisource has the text of the 1905 New International Encyclopedia article Tariff. |

- Types of Tariffs

- Effectively applied tariff by Country 2008 to 2012

- MFN Trade Weighted Average Tariff by country 2008–2012

- World Bank's site for Trade and Tariff

- Market Access Map, an online database of customs tariffs and market requirements

- WTO Tariff Analysis Online – Detailed information on tariff and trade data

Clash Royale CLAN TAG#URR8PPP

Clash Royale CLAN TAG#URR8PPP